Understanding ACH Payments:

A Small business Owner’s Guide

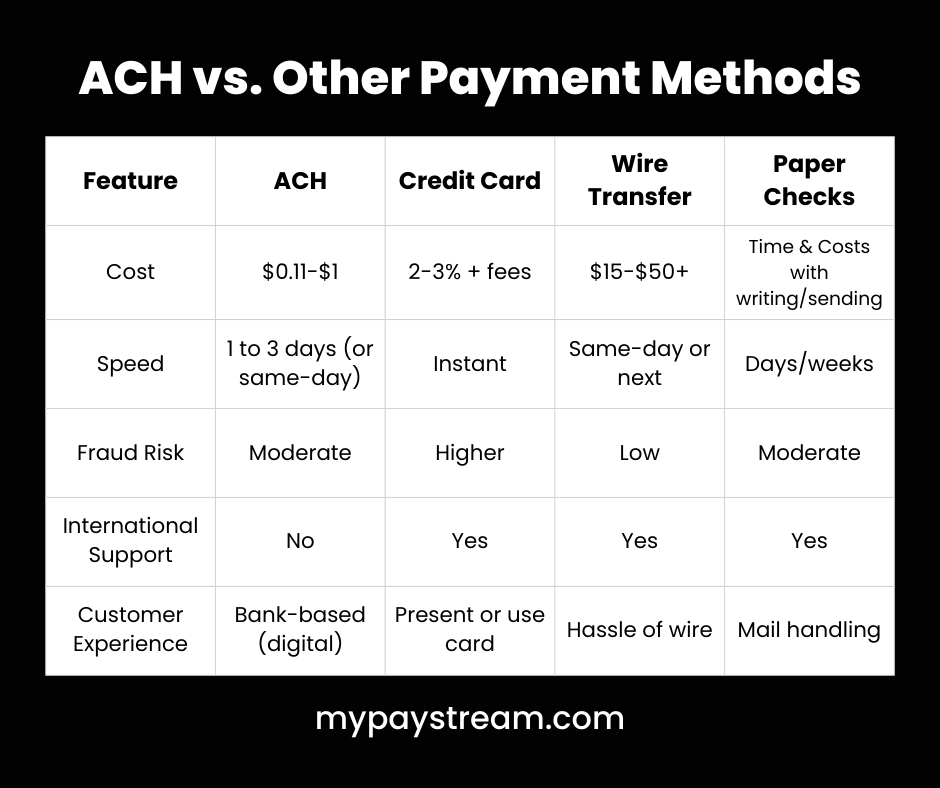

In an increasingly digital world, sometimes even credit cards seem outdated. A check is just about archaic. Enter the ACH payment, or electronic bank-to-bank transfers. They are a powerful and cost-effective way to move money. ACH provides a seamless alternative to checks and cards and can be used to pay your staff, collect recurring payments, or make vendor payments. Here, we're explaining what ACH is, how it works, and how it can benefit your business.

What is an ACH Payment?

What Is an ACH Payment?

An ACH (Automated Clearing House) payment is an electronic transfer of funds between bank or credit union accounts through the U.S.-based ACH network. Have you ever received a paycheck via direct deposit or used automatic payments for your bills that use your checking account number? If so, you have completed an ACH transaction.

There are two common types of ACH transactions:

ACH Credits is where you (the payer) are pushing funds into an account, like making payroll or vendor payments.

ACH Debits are when your business pulls funds from a customer's account with their permission, which comes in handy for subscriptions or invoices.

What is the ACH Network?

Nacha regulates and manages the ACH network. It is the foundation for how money and its related data move electronically in the U.S. It includes:

Originating Depository Financial Institutions (ODFIs) These are the initiators of ACH transactions.

Receiving Depository Financial Institutions (RDFIs) These institutions are the recipients of the transactions.

ACH Operators Such as the Federal Reserve and The Clearing House.

Transactions within the ACH network are processed in batches, ususall three times a day, because it is more efficient and reduces costs. Some providers even offer same-day ACH services.

Why We Love ACH

Cost Savings ACH transactions typically cost between $0.11 and $1 each. Making ACH fees significantly lower than credit card fees or wire transfer charges.

Seamless Automation ACH makes recurring payments like subscription, membership, or service plan installments easy, reliable, and profitable.

Reliable Cash Flow Automated payments ensure a consistent and predictable cash flow with fewer missed payments.

Low Friction for Customers. Customers input their banking information once, and then enjoy a hassle-free experience, enjoying convenience and the added security this option offers.

What Are The Potential Downsides of ACH?

Processing Delays Standard ACH transactions take 1 to 3 business days to process, while same-day options are available to some, additional fees most-likely apply.

Limited Reach ACH transactions are only available in the U.S. and Puerto Rico. International or prepaid‑card payments are not supported.

Transaction Rejections Common reasons for rejected transactions include:

R01: Insufficient funds

R02: Account closed

R03: No account found

R04: Account not set up for ACH

Fraud Risk Slightly higher risk than cards because ACH doesn't require PCI compliance like credit and debit cards. Maintaining security is still critical.

How to Get Started with ACH

If you are interested in using ACH transactions for your business, it's relatively easy to get started.

Choose a Processor Check to see if your existing provider offers this option. If not, select a provider that supports ACH, like we do.

Gather Info Collect the necessary information and details that you'll need to set up your account. These include: bank name, routing number, account number, and account type.

Obtain Authorization Secure written or electronic authorization for ACH debit transactions.

Integrate Systems Connect ACH into your accounting, billing, or CRM system(s).

Review Limits Familiarize yourself with same-day processing options, transaction limits, and their associated fees/costs.

Final Insights

ACH payments are an essential tool for managing your payments efficiently. They are streamlined, cost-effective, and friendly for customers. If your business handles recurring invoices, payroll, or vendor payments, integrating ACH can provide you with a reliable and low-cost advantage.

Do you need assistance with setting up ACH or reviewing your payment process?

👉 Schedule a free payment strategy session with Todd and discover how ACH can fit and fuel your business growth.

FAQ

Q: Are ACH payments safe and secure?

Yes, as long as you use encryption, strong authentication, and reputable processors.

Q: Can I process international ACH transfers?

No ACH works only in the U.S. and Puerto Rico.

Q: What happens if an ACH transaction is rejected?

You may incur a fee. Common reasons for rejection include insufficient funds, account closure, or incorrect account data.

Q: Do customers need credit cards for ACH?

No, just banking info. It’s great for customers who prefer not to use cards or want fewer fees.

Q: Do all processors support same-day ACH?

No, only select processors do, and there is usually an upcharge for the service. Ask your provider.

Want to get ahead of the curve? Let’s talk.