Why Staying on the Wrong POS Could Be Costing You More Than You Think

How Square Might Be Silently Cost You Big

Recently, had coffee with the owner of a beauty studio. She was doing everything right: her financial records were solid, her marketing strategies were effective, and her team was busy. However, there was one issue quietly draining her time, money, and momentum: she was still using Square.

Not because it was working well for her, but because it was familiar and easy to use. The thought of searching for a new solution and the effort required to implement it seemed daunting and not worth it. This thought process isn't a criticism of Square (or Shopify); these platforms have their place, particularly for new or product-only businesses.

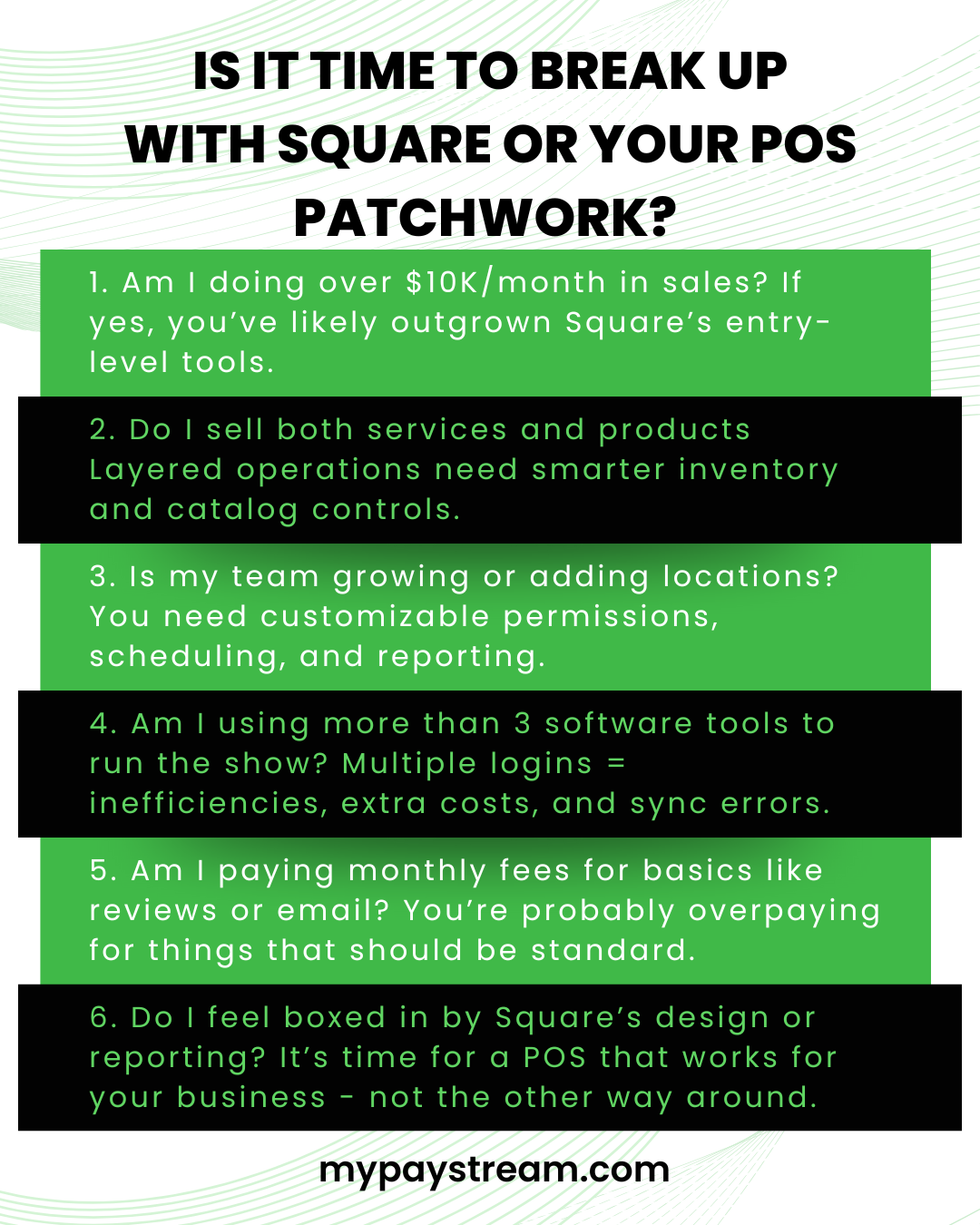

However, if you're bringing in over $10,000 a month in sales and planning or trying to scale a service-based business that also sells products, it's probably time to consider an upgrade. Here's what I explained to her, and what I want all growth-minded business owners to understand.

Is Square the Problem?

Yes…and No.

Square's a great entry point. It's easy to set up, decent for basic transactions, and provides some useful early tools. But it wasn't designed for growth.

Here's where Square starts to fall short once you're no longer the "new kid on the block":

Reporting That Doesn’t Go Deep

You want to analyze profitability by staff, service, product, or time slot? Good luck. Square's reports are basic, and when you need to make real business decisions, you're left exporting spreadsheets and cross-referencing in Excel. Both time-consuming and potentially expensive if you don't have the time or money to do both the legwork and the analytics yourself.

Limited Inventory and Staff Controls

Managing retail SKUs, add-on services, or multi-location pricing is clunky. Square wasn't built for layers of permissions, complex team structures, or inventory and materials. Think about the difference in how you report back-bar items, supplies, and other raw materials vs. the products and services you sell to the customer, and how clunky it is to manage all of that in Square.

Marketing & Loyalty = $$$

Want to send emails? That's another monthly fee. Review requests? Also extra. Loyalty programs? Yup, pay up. All these things that should be standard business tools are upsold. These costs increase your monthly outlay, add in the processing fees, and your payout to Square is significantly larger than necessary, eating away at your profits.

No Real Customization

You're stuck with Square's structure. You're stuck with its vibe and its look. It serves everyone… so it doesn't serve you specifically. If beauty and expressing creativity help set you apart, Square puts you at a loss. And at a certain point, your business needs something more purpose-built.

Bottom Line?

If Square were a pair of shoes, it's like wearing flip-flops to a 10K race. Comfortable? Sure. But they won't get you where you're going without some pain.

“But It All Talks to Each Other. . .”

The Real Cost of Patchworked Platforms

One of the most common things I hear is:

"Well, it all integrates. I can book clients, take payments, email them, and get reviews in one system."

But is it really one system?

Typically, it's Square, plus a bunch add-ons, some of them might be third-party, each with its monthly fee, login, and risk of glitches. When we break it down, this is what it often looks like

:

Square Feature + Monthly Cost (Typical)

Retail Plus $60

Loyalty Add-On

$45+

Email Marketing $15–$50

Review Platform $10–$40

Extra Staff Access $35–$75

That "affordable" POS suddenly costs hundreds a month; it still doesn't give you a seamless workflow, and it doesn't include processing fees!

Another scenario involves using a website provider like Squarespace or Wix. A Square shop (with Retail Plus subscription) is linked for product sales and service checkout, and then another platform, such as Vagaro, is used for appointments, client management, and email marketing. If we break that down:

Square Retail Plus $60

Square Loyalty Add-On $45+

Square Review Platform $10-$40

Extra Staff Access $35-75

SquareSpace/Wix $45

Vagaro $70

Plus processing fees! It is costly.

Pro tip: Do a tool audit. Write down every piece of software, every subscription, and what each does. You'll likely find that a robust POS platform tailored to your industry can streamline your processes and save you money.

If you don't have the time, we're here to help.

Look At The Numbers

Let’s break it down. With an average transaction of $158.58, and 67 transactions per month, the POS platform cost alone can add $3.36 to $5.00 per sale - just to operate. That’s a 2.1% to 3.2% hit to your margins, every single time.

Over the course of a year (about 700 transactions), that’s a $2,700 to $4,020 loss that could be avoided with a smarter solution.

“But Switching Is Too Hard”

Here's What Can Happen (When You Have the Right Partner)

Listen, I get it. No one wakes up thinking, "Today's the day I switch my POS."

However, the cost of not switching, including missed data, time spent on workarounds, and lost revenue from poor reporting or related subscription costs, adds up quickly.

At PayStream, we take on 90% of the transition process for you:

Data Export We help pull everything from Square (customers, services, pricing, etc.)

Menu & Catalog Buildout We help rebuild your products and services into the new system

Custom Programming We adapt the POS to match how you operate

Hands-On Support We train your staff and stay on until go-live

By the end of the week, you're running more efficiently and wondering why you didn't do this six months ago.

Example of POS That Works Better for Service or Beauty Businesses

If you love Square's simplicity: Try Clover. It's a user-friendly upgrade with more control, flexible hardware, and is better supported by processors like PayStream, which can keep your processing and interchange fees low and under control.

If you want next-level functionality specific to beauty: Go for Growthzilla, a powerhouse platform purpose-built for appointment-based businesses.

Growthzilla offers:

CRM + built-in marketing

Advanced scheduling

Automated reviews & loyalty

Deeper reporting tools

Direct integration with PayStream (no forced high rates)

Bonus? Growthzilla is processor-agnostic. This means that you are not locked into inflated group rates from large providers like Square or Shopify, and neither your account nor your cash flow is at their mercy. PayStream can help you secure the best possible rates, allowing you to retain more of your profits.

And What About Shopify?

Shopify's incredible for e-commerce. So, if you're shipping products, yes. But if you run a service-based business like a salon, studio, construction, or landscape business, here's why it's not ideal:

Scheduling features are add-ons = more operating expense

Expensive, proprietary hardware

Built for product sales, not people-based services

"Basic needs" are often monetized as upgrades

If your business is service-first, Shopify may be a stretch and eventually a roadblock.

Why the Switch Is Worth It

The PayStream Advantage

When you work with us, you're not just "getting a new POS." You're getting a system that works for your business, not against it.

A streamlined, custom-built platform

Lower operating costs by eliminating excess apps

Better client experience (and happier staff)

Reduced processing fees through more innovative integration

Tech that can grow with you

1:1 personalized customer service

At PayStream, we're not here to sell you software. We're consultants who help service businesses unlock their next level of growth with the right payment tools, not just the popular ones. Stability Starts with Smarter Payments

Final Thought:

If you're feeling boxed in, frustrated, or overwhelmed by your current setup, trust that instinct.

The tools that helped you get off the ground may not be the ones that take you to your next chapter.

Let's have a conversation. We'll walk you through the options, the numbers, and the path forward, no pressure, just clarity.

Ready to stop settling for a starter system?

Let's chat about where your business is heading and make sure your POS can keep up. Schedule a free consult with PayStream

FAQs

1. When is it time to upgrade from Square to a more advanced POS system?

If your business is bringing in $10,000+ per month, has multiple staff members, or sells both services and products, it’s probably time to upgrade. Square was designed for startups, not growing, service-based businesses. Service businesses include Personal, Business, Home and Maintenance, Medical, Travel, Fitness and Wellness.

2. What are the limitations of Square for service-based businesses?

Square lacks deep reporting, custom workflows, and inventory controls. It also relies heavily on paid add-ons for email marketing, reviews, and staff management, making it costly and inefficient as your business grows.

3. Can Square handle multi-location or multi-staff businesses effectively?

Not well but possible with patience. Square’s permissions and team structures are limited. Businesses needing layered staff access or location-specific pricing and reporting often struggle to scale within Square.

4. How do Square’s extra fees and add-ons affect profitability?

Square charges extra for essential tools like loyalty programs, email campaigns, review management, and advanced staff access. These monthly fees add up, cutting into your margins significantly.

5. What’s the real cost of using multiple third-party integrations with Square?

Integrating Square with platforms like Wix, Vagaro, and others creates a patchwork system that’s harder to manage and can cost hundreds in monthly fees, plus the risk of downtime, syncing errors, and inconsistent client experiences.

6. What are better alternatives to Square for beauty, wellness, or appointment-based businesses?

Platforms like Clover and Growthzilla offer deeper functionality, better reporting, built-in marketing tools, and custom POS configurations designed for service-first businesses. There are many other platforms available and consulting with a merchant partner like PayStream to find the right fit for your business is a good idea.

7. How hard is it to switch from Square to another POS system?

With PayStream, the transition is easy. We handle 90% of the process, including data exports, menu setup, team training, and going live so you can focus on your business, not the tech.

8. Will switching from Square save me money long-term?

Yes. A tailored POS system reduces the need for paid add-ons and third-party apps, streamlines operations, and often offers lower processing rates saving you both time and money. When you consult with PayStream we lay it all out for you.

9. Why isn’t Shopify a good fit for service-first businesses like salons or studios?

Shopify is designed for product sales, not service delivery. It lacks native scheduling, charges for proprietary hardware, and monetizes many essential features making it less efficient for appointment-driven businesses.

10. How can I find out if I’m overpaying or using the wrong payment tools?

Schedule a FREE PayStream consult. We'll audit your tools, costs, and setup to see if a better system could save you time, increase revenue, and support your growth goals with zero pressure.